st louis county personal property tax receipt

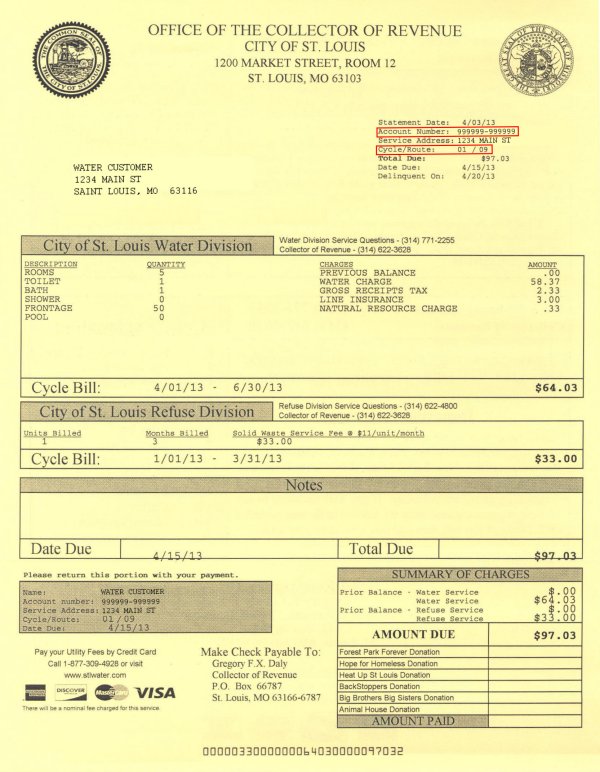

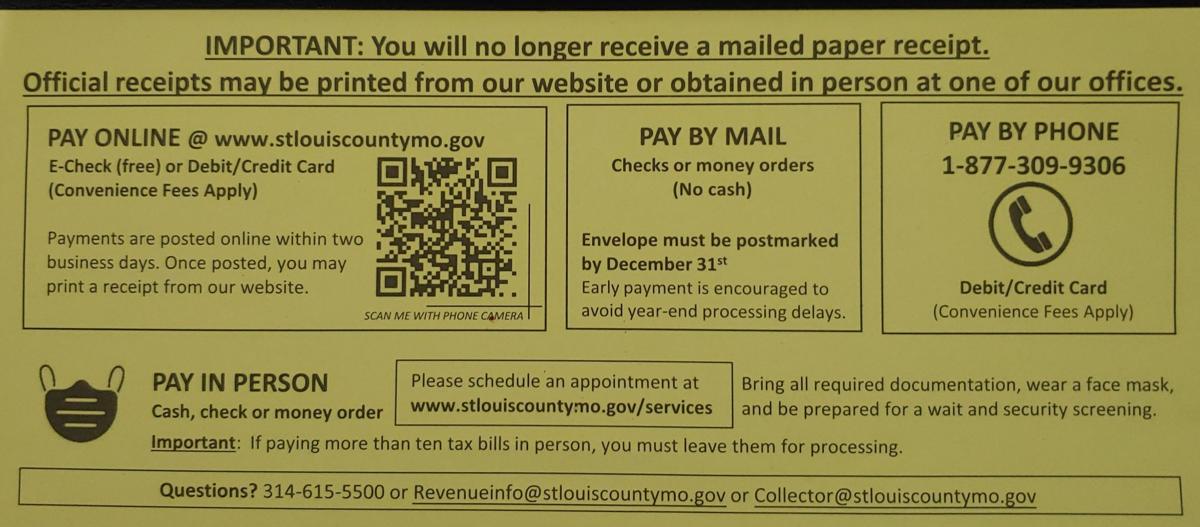

This means your check may not clear your bank quickly and you wont be able to print your. Obtain a Personal Property Tax Receipt Instructions for how to find City of St.

Revenue St Louis County Website

Collector of Revenue FAQs.

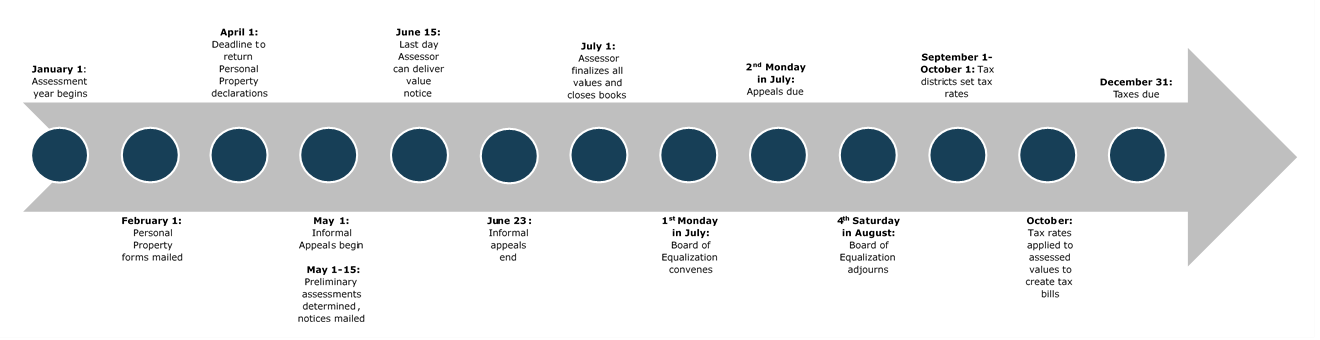

. If you opt to visit in person please schedule an appointment. To declare your personal property declare online by April 1st or download the printable formsIf you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing email protectedstlouis-mogovYour feedback was not sent. Real estate property taxes.

If April 1st is a. For a pamphlet with information on Small Claims Court call 314-615-2601 or 314-615-2592. Instructions for how to find City of St.

Missouri State Statutes mandate the assessment of a late penalty and interest for taxes that remain unpaid after December 31st. You can also obtain a receipt for 100 at one of our offices. The Duplicate Receipts need to be retrieved from the Collectors Office after payment with cash check money order or creditdebit card.

Saint Charles MO 63301-2889. If you have any questions you can contact the Collector of Revenue by calling 314 622-4105 or emailing propertytaxdeptstlouis-mogov. Louis personal property tax history print a tax receipt andor proceed to payment.

Charles County Collector of Revenue 201 N Second St Suite 134 Saint Charles MO 63301 and the. Obtain a duplicate of your original property tax receipt on the ground floor of The Online Property Search Program all for free. Welcome to the Collector of Revenue Website Sunday April 10 2022.

Personal property account numbers begin with the letter I like in Individual followed by numbers. Obtain a Tax Waiver Statement of Non-Assessment Residents with no personal property tax assessed in the prior year can obtain a statement of non-assessment tax-waiver Obtain a Real Estate Tax Receipt Instructions for how to find City of St. Louis collectors office sent you receipts when you paid your personal property taxes.

Louis County has been mailing out yellow slips stating the change with real estate and personal property tax bills. All personal property assessment forms are to be returned to the County Assessor no later than March 1st. Address Collector of Revenue Office St.

Declare Your Personal Property Declare your personal property online by mail or in person by April 1st and avoid a 10 assessment penalty. 201 N Second St Suite 134. You must present the receipts an original photocopy fax copy or copy of an internet confirmation screen is acceptable when you obtain license plates.

The Assessment lists are mailed by the Assessors Office in January of each year. Mail a request stating the account numbers and tax years for which Duplicate Receipts isare requested along with a check or money order for the total number of receipts requested times the 1 statutory fee to. Property 3 days ago Search by Account Number or Address.

Declarations are due by April 1st of every year. Your county or the city of St. Property Tax Receipts are obtained from the county Collector or City Collector if you live in St.

Assessing Personal Property Tax. To declare your personal property declare online by April 1st or download the printable forms. Louis City in which the property is located and taxes paid.

Louis real estate tax payment history print a tax receipt andor proceed to payment. Search by Account Number or Address. The change is also posted on the Countys Collector of Revenue website but.

For information call 314-615-8091. Personal Property Tax Declaration forms must be filed with the Assessors Office by April 1st of each year. Definition of Tangible Personal Property Every tangible thing being owned or part owned weather animate or inanimate other than money household goods wearing apparel and articles of personal use and adornment as defined by the State Tax.

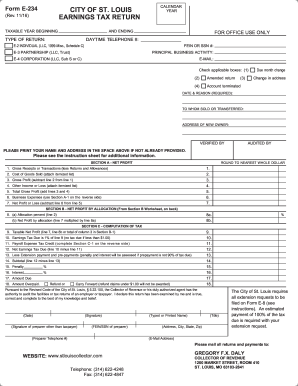

Fees apply to the purchase and printing of paper copies of income tax receipts every tax year. Even if the property is not being used the property is in service when it is ready and available for its specific use. Tax receipts and payment history for real estate tax and personal property tax are available online.

If you did not file a Personal Property Declaration with your local assessor. The Collector efficiently manages this complex and overlapping taxing environment by offering a centralized process to expedite the receipt and distribution of over 24 billion annually for personal property taxes real estate property taxes railroad taxes utility taxes merchants taxes and manufacturers taxes. Louis County Circuit Court 7900 Carondelet in Clayton Monday through Friday 800 am to 500 pm.

Louis City Hall Room 109 1200 Market Street St. Louis MO 63103-2895 Phone. Personal Property Tax Lookup And Print Receipt.

Per Missouri Revised Statute 137122 property is placed in service when it is ready and available for a specific use whether in a business activity an income-producing activity a tax-exempt activity or a personal activity. How Do I Get A Copy Of My Personal Property Tax Receipt In Jackson County Missouri. All Personal Property Tax payments are due by December 31st of each year.

Leave this field blank. You may click on this collectors link to access their contact information. Obtaining a property tax receipt.

Obtain a Personal Property Tax Receipt. 415 E 12th Street Kansas City MO 64106. Louis personal property tax history print a tax receipt andor proceed to payment.

Your feedback was not sent. Obtain a copy of your property tax receipt from the offices in advance. Personal property taxes for your car motorcycle trailer etc.

How Do I Get A Copy Of My Personal Property Tax Receipt In St Charles Mo. An additional 1 fee applies to each duplicate receipt. You may file a Small Claims case in the St.

Paid Personal Property Tax Receipts. Personal property taxes are levied annually against tangible personal property and due upon receipt of the tax bill but no later than December 31 each year. Due to the volume of tax payments received at the end of the year processing takes well into January.

St Louis County No Longer Mailing Personal Property Real Estate Tax Receipt Unless Requested Youtube

A Midas Touch Home St Louis Missouri

Print Tax Receipts St Louis County Website

St Louis County Directs Residents To Go Online For Property Tax Receipts Politics Stltoday Com

Collector Of Revenue St Louis County Website

Get And Sign St Louis Mo City Earnings Tax Form 2016 2022

Filing Your St Louis County Personal Property Tax Declaration Robergtaxsolutions Com

How To Find A St Louis City Personal Property Tax Receipt Online Payitst Louis

Assessor About The Assessor S Office

Personal Property Declaration St Louis County Fill And Sign Printable Template Online Us Legal Forms

Online Payments And Forms St Louis County Website

A Midas Touch Home St Louis Missouri

Look For Property Tax Bills In Mail You Can Avoid Lines By Paying Online St Louis Call Newspapers

St Louis County Property Tax Deadline